mississippi income tax rate

Mississippi income tax rate and tax brackets shown in the table below are based on income earned between January 1 2020 through December 31 2020. If you are receiving a refund.

Mississippi Tax Rate H R Block

The graduated income tax rate is.

. Your 2021 Tax Bracket to See Whats Been Adjusted. First and foremost is the way it treats retirement income. Mississippi also has a 400 to 500 percent corporate income tax rate.

There is no tax schedule for Mississippi income taxes. These rates are the same for individuals and businesses. Individual Income Tax.

If youre married filing taxes jointly theres a tax rate of 3 from 4000. Sales Tax is based on gross proceeds of sales or gross income depending upon the type of business as follows. Mississippis sales tax rate consists of a state tax 7 percent and local.

Mississippi residents have to pay a sales tax on goods and services. Mississippi exempts all forms of retirement income from taxation including Social Security benefits income from an IRA. Mississippi has a graduated individual income tax with rates ranging from 400 percent to 500 percent.

However the statewide sales tax of 7 is slightly above the national average. Compare your take home after tax and estimate. Detailed Mississippi state income tax rates and brackets are available on this page.

The Mississippi Single filing status tax brackets are shown in the table below. All other income tax returns. Gunn said he anticipates the governor will sign the legislation and like him continue to work to eliminate the.

Mississippi residents will pay lower income taxes in coming years as the state enacts its largest-ever tax cut. Tate Reeves on Tuesday signed a bill that will. Mississippis income tax brackets were last changed four years prior to 2020 for tax year 2016 and the tax rates have not been changed since at least.

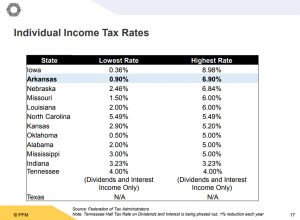

In Mississippi theres a tax rate of 3 on the first 4000 to 5000 of income for single or married filing taxes separately. If you make 70000 a year living in the region of Mississippi USA you will be taxed 11472. Give Mississippi when fully implemented the fifth-lowest marginal tax rate for states that have income tax although other states are also considering cuts or elimination.

Mississippi sales tax rate. The income tax in the Magnolia State is. Details on how to.

Ad Compare Your 2022 Tax Bracket vs. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. Compare your take home after tax and estimate.

2022 Mississippi Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Discover Helpful Information and Resources on Taxes From AARP. Mississippi has a graduated tax rate.

All sales of tangible personal property in the State of Mississippi are subject to the regular retail rate of sales tax 7 unless the law exempts the item or provides a reduced rate. Outlook for the 2021. Mississippi has a graduated income tax rate and is computed as follows.

0 on the first 3000 of taxable income. Mississippi State Income Tax Forms for Tax Year 2021 Jan. But if legislators take no action the tax rate will remain at 4.

3 on the next 2000 of. The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022. The personal income tax which has a top rate of 5 is slightly lower than the national average for state income taxes.

These income tax brackets and rates apply to Mississippi taxable income earned January 1. Mississippi Income Tax Forms. How do I compute the income tax due.

Mississippi Income Tax Calculator 2021. 2020 Mississippi Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Your average tax rate is 1198 and your marginal.

State Corporate Income Tax Rates And Brackets Tax Foundation

Mississippi Tax Rate H R Block

Strengthening Mississippi S Income Tax Hope Policy Institute

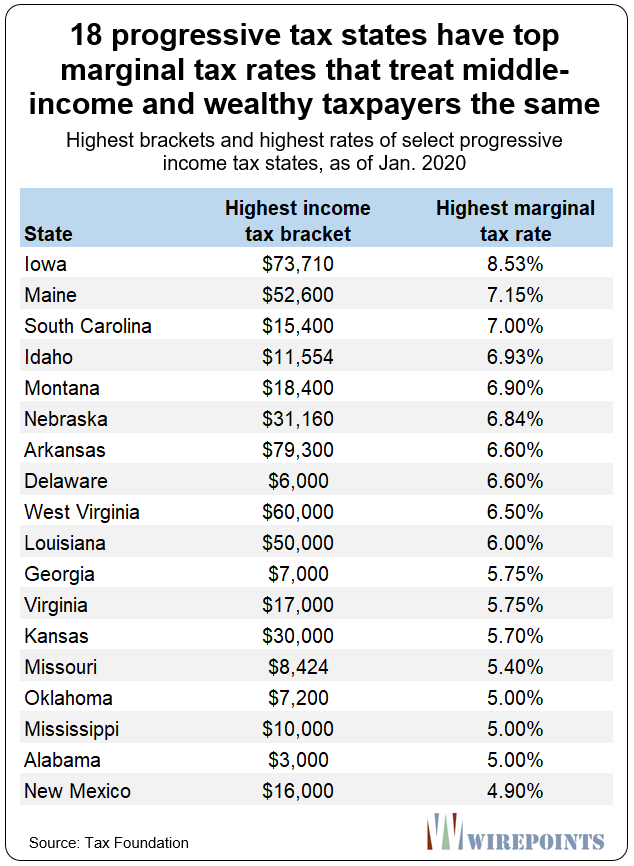

18 Progressive Tax States Have Top Marginal Tax Rates That Treat Middle Income And Wealthy Taxpayers The Same1 Wirepoints

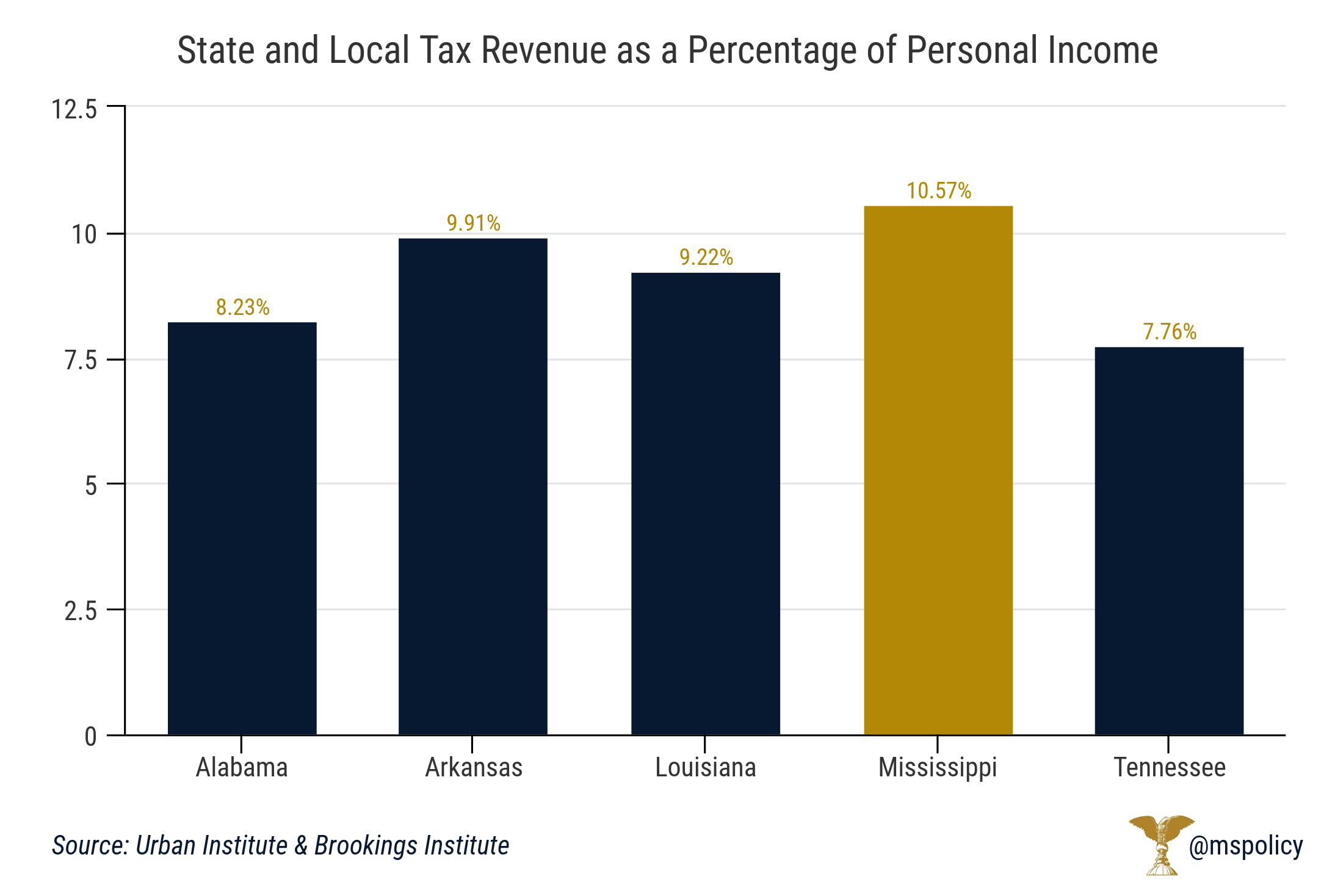

Mississippians Have Among The Highest Tax Burdens Mississippi Center For Public Policy

Are California S Taxes Really That Bad R California

Historical Mississippi Tax Policy Information Ballotpedia

Mississippi Income Tax Calculator Smartasset

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Mississippi Who Pays 6th Edition Itep

It S All About The Context A Closer Look At Arkansas S Income Tax Arkansas Advocates For Children And Families Aacf

Tax Friendly States For Retirees Best Places To Pay The Least

Individual Income Tax Structures In Selected States The Civic Federation

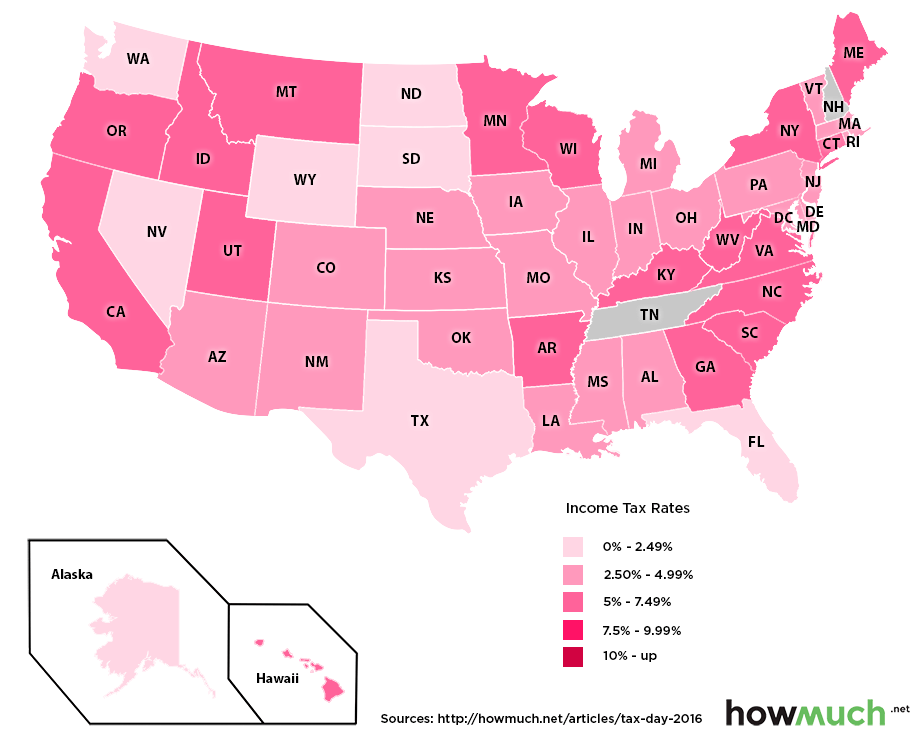

Which U S States Have The Lowest Income Taxes

Tax Rates Exemptions Deductions Dor

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

The Most And Least Tax Friendly Us States

Report Shows Mississippi 7th Highest In State Local Tax Burden Mississippi Politics And News Y All Politics